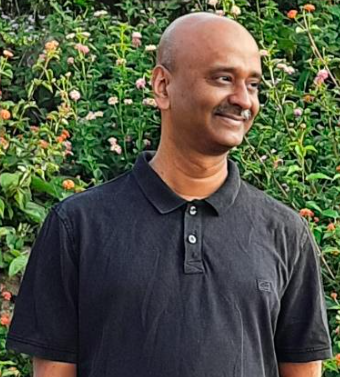

CEO and co founder (Learning Matters)

- When an invoice is raised and sent to a customer, we pay GST during the same calendar month, without really ensuring that invoice is honoured by the customer. When the invoice amount runs to a few lakhs Rupees, paying GST ahead of time is a little difficult. Also, a few times the customers default on payment. We end up paying GST without even getting paid for our services delivered to the customer. As a small organisation, we do not have resources to file case and follow up. Many times, we end up not paid at all for our services, but we end up paying GST. Can the government do changes to help small companies in the above situation?

- Can all government (state and NCERT) books be made open source for reuse by companies like ours for educational products? That will be a great help.